The Capital One Savor review: A $300 bonus, and huge returns for food delivery

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.

The Capital One Savor Cash Rewards Credit Card is a foodie’s find for everyday spending. If you take food seriously, it’s common sense to use a card with generous bonus categories for dining, entertainment and groceries, and it collects the simplest kind of rewards — sweet cash. It even comes with a $300 bonus after you spend $3,000 on purchases within the first three months of account opening.

If you don’t have time to delve into the complexities of miles and points, this is the card for you. Easy to earn, easy to redeem. And you can use the cash for anything, not just travel. It’s one of the best cash back credit cards on the market. The card is even sweeter during this painful stretch of government-mandated social distancing. While restaurants and bars are closed, you can still order takeout/delivery and receive 4% back on your spending — that’s one of the best returns you can possibly get for food. And if you’re stocking up for worst-case scenarios like many of us, you’ll get 3% back at grocery stores (excluding superstores like Walmart and Target), too.

I’ll give you a full review of the Capital One Savor

The information for the Capital One Savor Cash Rewards card has been collected independently by Million Mile Secrets. The card details on this page have not been reviewed or provided by the card issuer.

Who is the Capital One Savor for?

If you spend a lot on dining, entertainment and groceries, and want a card that gives you cash back, you’re reading the right review. This card is all about dining and entertainment.

As long as you don’t have five or more open Capital One cards, you’re eligible for the Capital One Savor card. If you’ve opened a Capital One card in the past six months, it’s best to wait. Capital One will generally only process a personal credit card application every six months. You also want to make sure you wait until your credit score is 700 or higher to have the best odds.

Also, if you’re new to the miles and points hobby, we recommend you open all the Chase credit cards you want first, because many come with substantial welcome bonuses and perks. And Chase has strict application rules.

Current bonus: A $300 value

Perhaps you’ve never had a cashback card. If not, read our “what is cash back?” post — and avoid these cash back credit card common mistakes.

With the Capital One Savor, you’ll earn $300 cash back after spending $3,000 on purchases within the first three months of account opening.

Again, because you’re earning straight cash instead of miles and points, your hands won’t be tied when redeeming the welcome bonus.

Benefits and perks

Lyft credits

If you ride with Lyft, Capital One Savor is the perfect card for you. The Savor card offers Lyft credits each month, because it’s a World Elite Mastercard. If you take five or more rides with Lyft during a month, you’ll earn $10 in credit for Lyft rides. This benefit resets each month, which means you can earn up to $120 in Lyft credits each year, and that more than covers the card’s annual fee.

World Elite Concierge

One of my favorite benefits of any credit card, World Elite Concierge is an underrated perk that more cardholders should use. The card comes with a low annual fee of $95, but you get access to a dedicated concierge.

The concierge can make dinner reservations, travel plans and can often snag last-minute concert tickets. The service is free and so underutilized by cardholders. I’ve managed to score some great last-minute reservations at popular restaurants and terrific seats at concerts thanks to the concierge benefit.

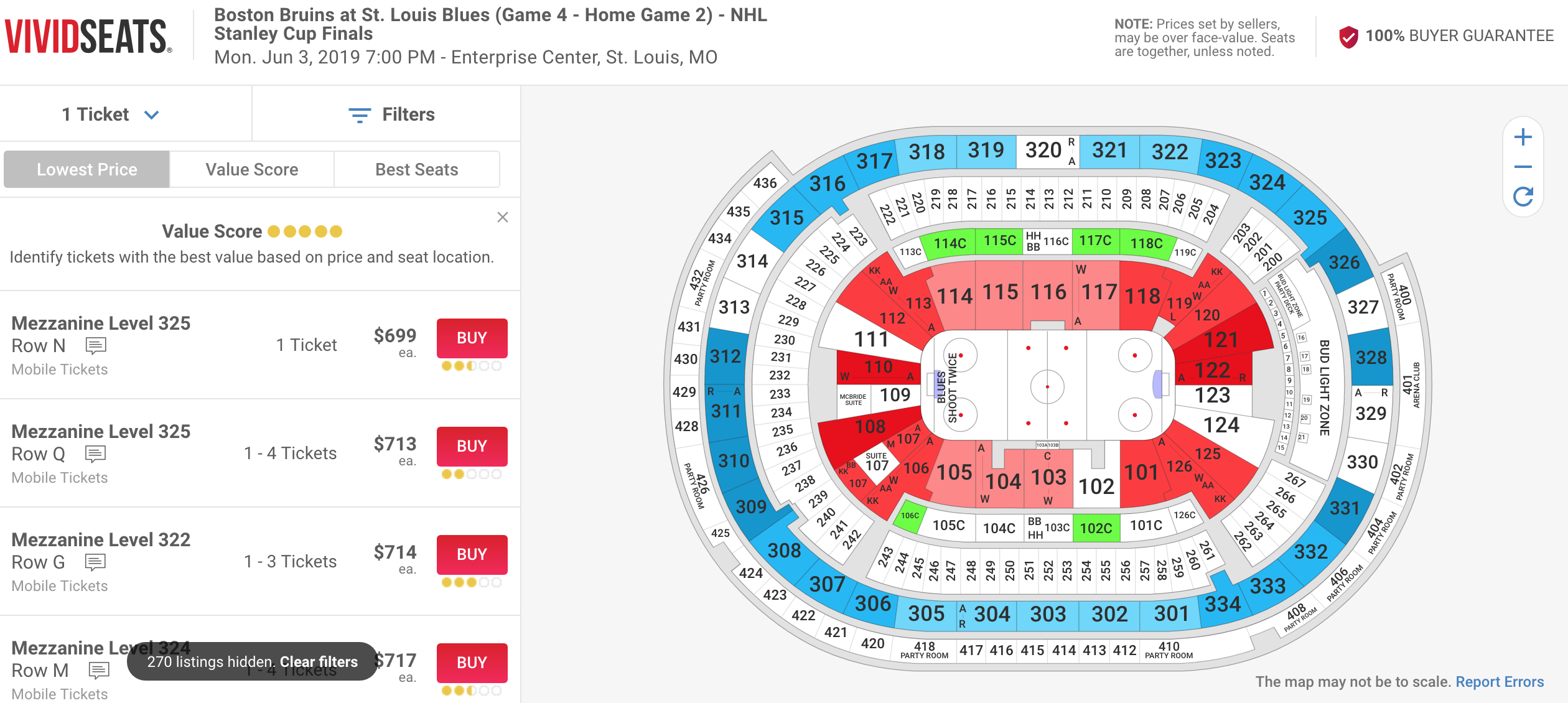

8% cash back with Vivid Seats

Not only can you earn 4% on entertainment purchases, but you can also earn 8% cash back with Vivid Seats through January 2022. Vivid Seats is a lot like StubHub. You can score cheap tickets to concerts and sporting events.

MMS writer Harlan managed to snag a pass to Bonnaroo, a music and arts festival in Tennessee, for $325 when tickets on the festival website were more than $400. Using the Capital One Savor card, he earned $26 for that purchase. That can cover a few beers at the festival.

If you plan to buy tickets to a concert, music festival or sporting event, Harlan recommends using Vivid Seats with your Capital One Savor card. You’ll earn a nice chunk of your purchase back in cash.

Extended Warranty Protection

The Capital One Savor will extend the manufacturer’s warranty by a year on eligible items.

If the manufacturer’s warranty is only available for three years or less, Capital One will cover your purchase.

Coverage is limited to the lesser of the following:

- The cost to repair or replace the item

- The purchase price of the item

- The amount charged to your Capital One Savor card

- $10,000 per item

There are several excluded purchases, like cars, tires, plants, animals, etc. You can check the Capital One website for more information on warranty protection.

Capital One Premium Access

With the Capital One Savor card, you get insider access to premium dining and entertainment and sporting events through the Capital One Access program.

Past Access Pass events include Capital One Jam Fest with Katy Perry, the iHeartRadio Music Festival and tickets to the NCAA Final Four. Other events include VIP treatment for events at the Capital One Arena in Washington, D.C., and exclusive reservations to top restaurants in cities like New York.

Car rental insurance

The Capital One Savor card offers secondary coverage for car rentals. If you already have insurance that covers car rentals, this benefit won’t kick in. If you use this benefit, it will cover things like scratches, fender benders and other damage.

Mastercard World Elite benefits and perks

The Capital One Savor Card is a World Elite Mastercard. This means that all the benefits offered with World Elite cards apply to the Savor card. The list of benefits is extensive.

Free ShopRunner 2-day shipping

This benefit will save you a lot of time and money if you shop online. The Capital One Savor card offers free 2-day shipping and returns at more than 140 stores including popular retailers like Neiman Marcus, Saks Fifth Avenue and Cole Haan through ShopRunner.

Price protection

If you find a better price on a recent purchase within 120 days of making that purchase, the Capital One Savor card might allow you to earn back the difference between the current price and the price you paid. Make sure you don’t rely too much on this benefit, as some purchases aren’t covered.

You can get up to $250 per claim and up to four claims per 12-month period.

How to earn and redeem cash back

In addition to the hefty welcome bonus, you’ll earn bonus cash back in certain categories:

- 4% cash back on dining

- 4% cash back on entertainment

- 4% back on popular streaming services

- 3% cash back at grocery stores

You’ll earn 1% cash back on all other purchases. There are no caps on how much bonus cash back you can earn. And these aren’t rotating categories that require you to enroll your card. Just memorize the categories and start swiping.

Redeeming cash back with the Capital One Savor is easy. You can request a check or statement credit, any time, with no minimum redemption amount. Or you can set up an automatic redemption, for example, $25 per month. Whatever is most convenient for you.

Is the annual fee worth it?

The Capital One Savor has a $95 annual fee. The card’s ongoing benefits make it one of the best Capital One credit cards out there. If you’ll use just a couple of the below perks, it’ll be easy to save more than you’re paying for the annual fee.

Insider secrets

The Capital One Savor bonus categories are probably more plentiful than you think. The card earns 4% on “entertainment,” which is a vast category that includes things like movies, plays, concerts, sporting events, tourist attractions, theme parks, aquariums, zoos, dance clubs, pool halls or bowling alleys, record stores and video rental locations.

Pairing the Capital One Savor with other credit cards

The Capital One Savor is not expressly a travel credit card, though it does have some travel-related perks — it’s merely a fantastic companion for dining and entertainment. If you’re a traveler, you’ll want a card that’s got a suite of travel benefits, like primary car rental insurance, baggage delay insurance, trip delay insurance, and bonus points for spending on travel.

Chase Ultimate Rewards points collecting cards, like the Chase Sapphire Preferred® Card or the Chase Sapphire Reserve® are fantastic complements to a solid cash back card like the Capital One Savor. They come with incredible travel insurance, and bonus spending for travel purchases like airfare, hotels, car rentals, and more. If you travel, the vast majority of your purchases will earn valuable bonus points/cash back with these two cards.

You can read our review of the Chase Sapphire Preferred here. And read our review of the Chase Sapphire Reserve here.

Bottom line

Capital One Savor is a great fit for foodies because of its generous dining bonus category. You also save on entertainment and groceries, so it’s a good card for everyday spending.

It comes with $300 cash back after spending $3,000 in the first three months of account opening.

You’ll earn:

- 4% cash back on dining

- 4% cash back on entertainment

- 4% back on popular streaming services

- 3% cash back at grocery stores

So if you spend a lot on food and are looking for a card with a plump welcome bonus and a simple earnings structure, the Capital One Savor card is worth considering.

You can also subscribe to our newsletter for more honest credit card reviews like this!

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!